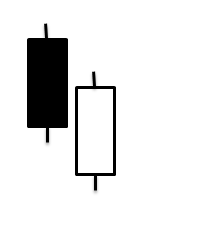

This pattern consists of two candles representing two consecutive days. Usually found at the end of a down trend, it starts bearish with a black candle and on the second day the candle reaches a new low but things soon change as suggested by the name.

The price does not stay at the low but instead the bulls take control back and reverse the trend all the way back up, about half way up the first candle so that the price finishes on a high.

If on the third day it finishes on a high then that would confirm this reversal further.

Please click on picture above to get a larger picture

Most candlestick patterns should appear close to previous resistance or support levels depending on what type it is. You should only trade a candlestick pattern if it's near these levels.

Don't trade using these patterns if it's not at the top or bottom of a trend. These patterns appear a great deal so you have to make certain you only trade at the right level.

This is very important as you will end up over trading them and you will end up losing more money than you imagined.