1. Never trade on all candlestick signals. This is important as trying to trade most signals is the quickest way to lose money. Not all candlestick signals should be used to buy or sell. You should consider the risk /reward aspect of the trade beforehand and also where the candles appear.

2. Doji should only be respected if it's in a trend(up or down). If it's in a middle of a box range then you would ignore this. This is true of all candlestick patterns.

3. Candlestick patterns can be used on all time frames.

4. Once you get a bullish engulfing pattern then this level should be used as support in the future. Same can be said for any major reversal pattern.

5. Aggressive traders can go long when the price retreats half way down the bullish engulfing pattern. Stops would be below the bullish engulfing pattern.

6. All major signals should form near known resistance or supports. The odds are better for a successful trade. This is the most important thing when using candlestick charts.

7. Small real bodies imply that the preceding trend momentum is slowing.

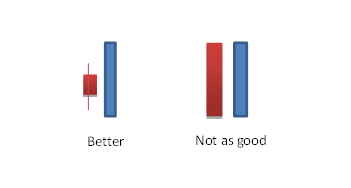

8. It's best to have a small real body than a big bullish engulfing pattern rather than equal size candles.

9. If you enter a trade on a Gap up, for example a island reversal but during the day the gap got filled then you should close out the trade. This is because the reason behind the trade is now no longer valid i.e. Gap got filled so it's not an island reversal.

10. If a share falls hard on a daily chart for 8-10 sessions then this could be considered oversold. If you then looked at the hourly chart and it's been going sideways then this may not be oversold anymore due to the sideways move. Sideways move actually eases the oversold or over bought conditions.

11. Gaps are called windows in candlesticks. Once the top window gets broken in a bull market then the bears may now be in control.

12. In a bull market you may get a few windows whilst the price moves up.

13. When the market gaps above a major resistance level then this could be worth going long.

14. Always use western technicals with candlesticks. They work perfectly together.

15. In an uptrend when the price reverses and heads to a previous gap up then it could be worth adding longs on the fill of the gap. Only do this on the first attempt.

16. At the extremes of known resistances, if this level has been touched more than 2 times in the past and reversed, then it could be worth going short the next time it reaches the same level. Only do this on the first attempt during that day and not on the second attempt.