Articles

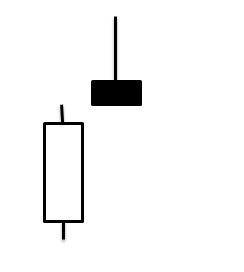

This pattern as the name suggest looks like a shooting star tumbling from the night sky, it consists of a small body were the price has closed lower than the opening price, it has a very long shadow above the body.

This pattern can be seen at the top of an up trend and signifies a reversal of a more bearish nature.

It shows that although the bulls pushed the price to a big high the bears were able to counteract and push the price all the way down to below the opening price.

However, to confirm this bearish pattern further you would need the next day also to finish on a low below the low of the shooting star.

Please click on picture above to get a larger picture

Most candlestick patterns should appear close to previous resistance or support levels depending on what type it is. You should only trade a candlestick pattern if it's near these levels.

Don't trade using these patterns if it's not at the top or bottom of a trend. These patterns appear a great deal so you have to make certain you only trade at the right level.

This is very important as you will end up over trading them and you will end up losing more money than you imagined.