Triangles

There are 3 types of triangles:

• Symmetrical triangle

• Ascending Triangle

• Descending triangle

These are all continuation patterns so are best used in the direction of the trend.

Symmetrical Triangle

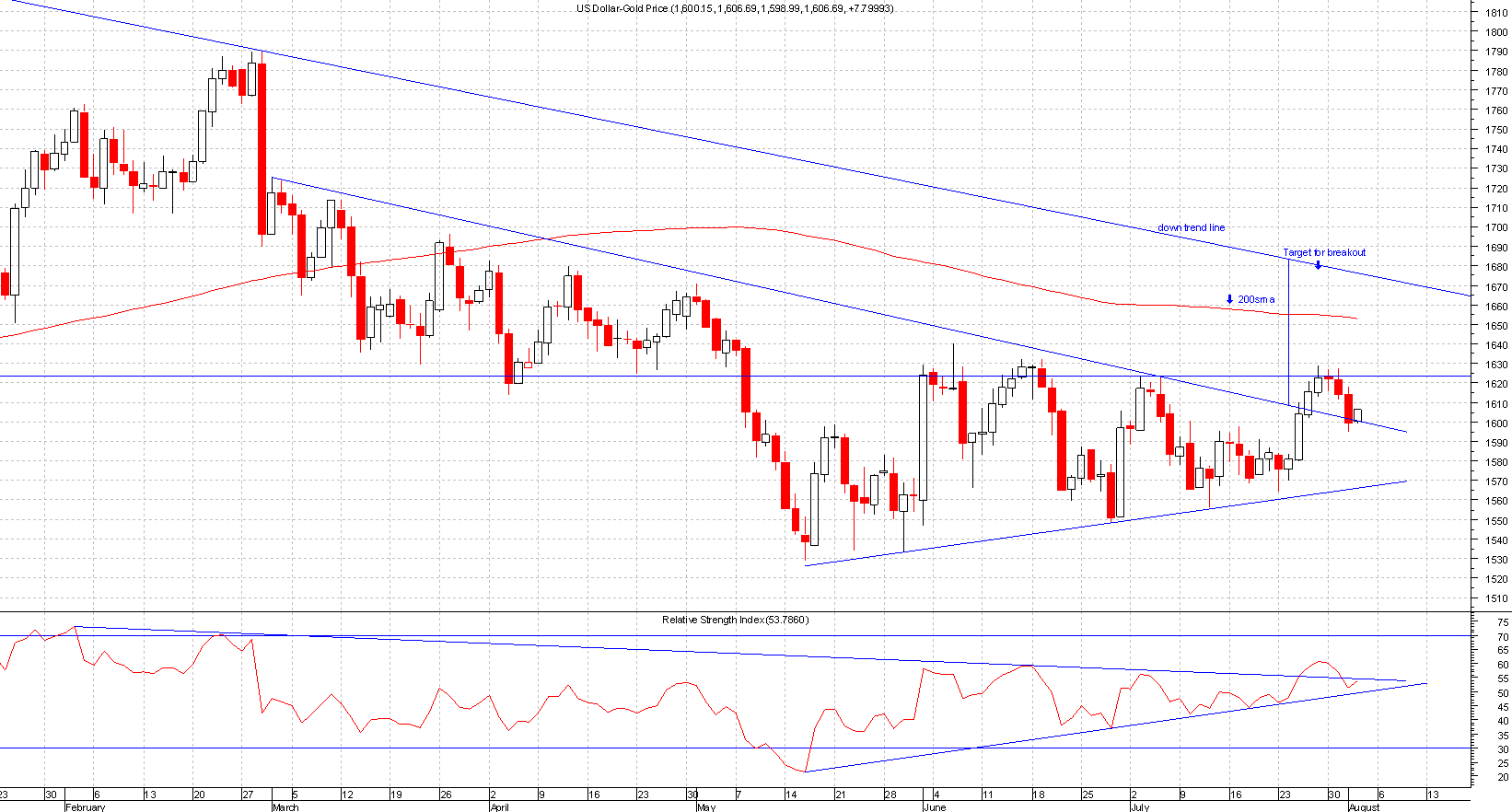

This has 2 converging trend lines that meet at the apex. The upper trend lines that is descending and the lower trend line that is ascending these meet at the apex.

The breakout favours the direction of the trend prior to the symmetrical triangle formation, For example:

If the trend was down then there is more of a chance of a downward breakout. Being a symmetrical triangle, you can trade the break in both directions but best to trade in the directions of the trend.

Most breakouts happen around the two thirds to three quarters of the length of the triangle. If the price moves past the apex of the triangle then it becomes void thus this actually has a time limit attached.

Please click on chart below for larger image

The signal comes once the price finishes the day above or below the trend line, the end of day price counts the most.

Once a breakout comes the trend line then becomes support or resistance depending on direction of breakout.

Its also quite common for a re-test to occur and volumes fade away as the triangle narrows. Volume should pick up once a penetrations occurs.

Targets

For the target you should use the widest point of the triangle as a measuring tool. If for example at the widest point it was 50 pips long then the target is going to be 50 pips from the breakout point.

Note: Triangle can take from 1 month to 3 months to form and any smaller than 2 weeks could be a pennant or flag.