Articles

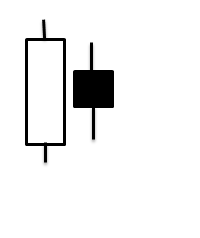

This pattern consists of two candles representing two consecutive days. Usually found at the top of an up trend, it starts bullish with a large white candle on the first day however on the second day the price gaps down.

This is the first sign that the bears have started to take some control back and indicates a reversal of the trend.

The bears maintaining their control and closing on a low enforces this sentiment further.

Please click on picture above to get a larger picture

Most candlestick patterns should appear close to previous resistance or support levels depending on what type it is. You should only trade a candlestick pattern if it's near these levels.

Don't trade using these patterns if it's not at the top or bottom of a trend. These patterns appear a great deal so you have to make certain you only trade at the right level.

This is very important as you will end up over trading them and you will end up losing more money than you imagined.