Inside-Bar Trading System - Review

in ChartsView Blog:- Font size: Larger Smaller

- Hits: 39669

- 4 Comments

- Subscribe to this entry

- Bookmark

This blog is basically an overview and update on my experience of using the inside-bar trading system, which I have been using for the past two months. I am very new to trading and wanted to try out a trading system rather than trade on my own. There are many trading systems out there so it was hard to decide which one to go for initially. However, I wanted to try one that was simple, easy to follow and one that wouldn't take up too much of my time and these are the reasons why I chose to do the inside-bar trading system.

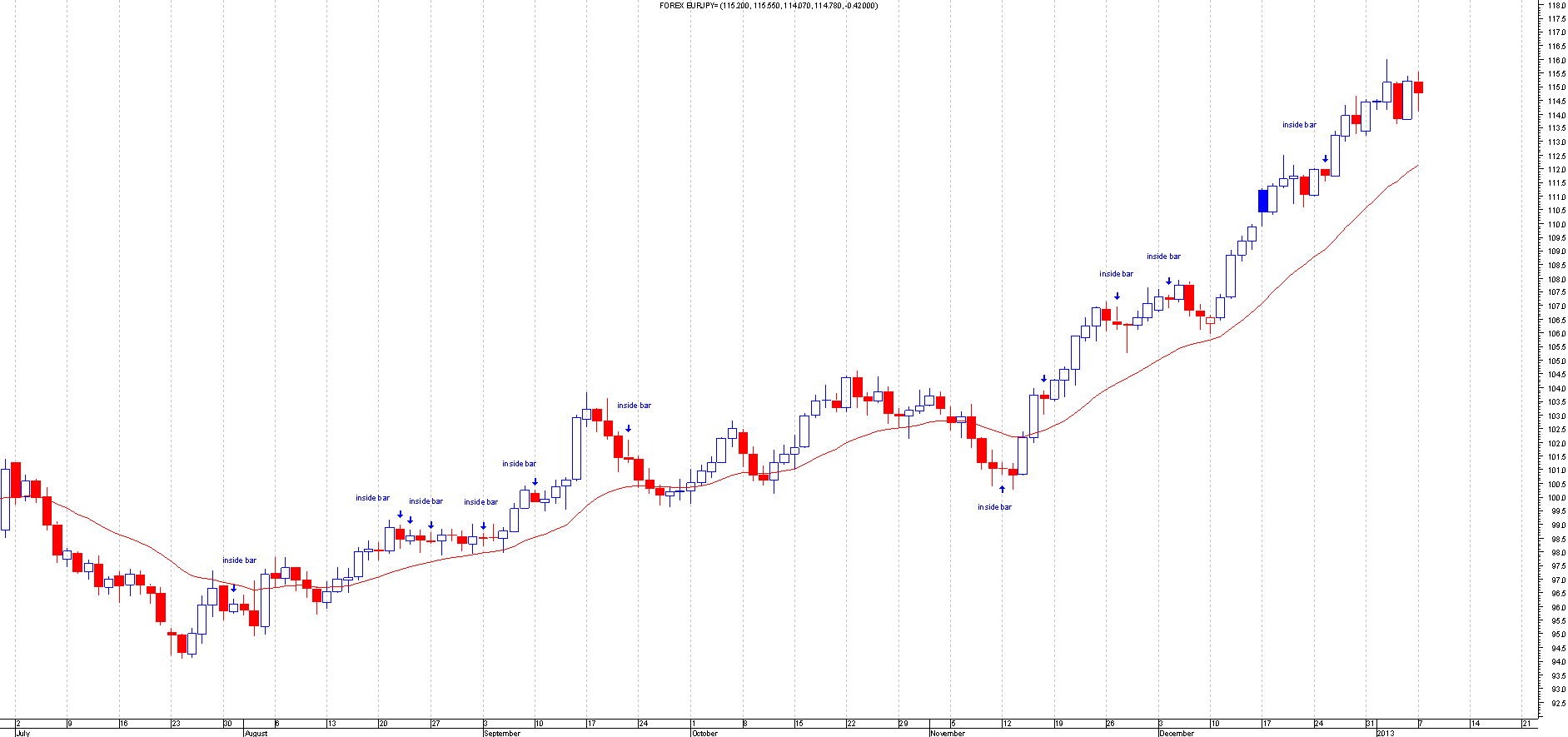

This system basically involves looking for an inside-bar, which is a bar contained within another bar or candle. Once you find one you then look at the 21(EMA) moving average, if the average is pointing up you would go long about 3-5 pips above the high of the inside-bar, if the average is going down than you would go short about 3-5 pips below the low of the inside-bar and that’s really it. Here is an example of what you are looking for:

If you want to learn more about this system please have a look at our learning section under Trading Systems

Its very simply to follow and what makes it so much easier is having a good charting package so you can see the bars clearly and accurately, I am using MetaStock Pro 12. If you cannot afford to get professional charting package you could try our 2-month free trial with MetaStock to see for yourself at 60-day Free MetaStock Trial

Anyway, back to the system another important thing with any system or any type of trading is to use the 2% rule, where you would only trade 2% of the capital you have. So this is what I have done and started trading with 50p per point, I know for a lot of people this would seems very little but at the end of the day you should always have good money management and due to my lack of experience I used the minimum bet possible.

One of the great feature of this system that you may not be aware of is that it is based on a ratio of 1/4, so for every 4 losses you make all you need is 1 win to make up for 4 losses. For example, when you place a trade you would put your stop at 50 pips but you put your limit at 200 pips so 4 times the stop. So if you were trading say 50p a point you would only lose £25 but would make £100. The truth is there are many losses but the idea is that the wins you have will recuperate your losses and hopefully make you more on top.

Well I have been doing this system for 2 months and it has been difficult because you have to follow the system strictly you cannot get too emotional attached or look at your trades during the day. You place your trade at 10pm every night (this is when the currency markets opens for the next day) and then you look at your trades the following day at 10pm. It has been very tempting to look at my trades during the day and on occasion I have changed trades, which goes against the system but I have learnt that it best to stick to the system and only check your trades the following day at 10pm.

Well these are the results of my trades for the past 2 months:

| Date | Market | Opening | Size | Closing | P/L | Points | |

| 28/12/2012 | Spot FX EUR/GBP | 8214 | 0.5 | 8164 | -25 | -50 | |

| 28/12/2012 | Spot FX EUR/GBP | 8153 | 0.5 | 8175 | 11 | 22 | shootingstar |

| 28/12/2012 | Spot FX EUR/USD | 13238 | 0.5 | 13188 | -25 | -50 | |

| 27/12/2012 | Spot FX USD/JPY | 8449 | 0.5 | 8649 | 100 | 200 | |

| 27/12/2012 | Spot FX USD/JPY | 8432 | 0.5 | 8632 | 100 | 200 | |

| 21/12/2012 | Spot FX AUD/USD | 10489 | 0.5 | 10439 | -25 | -50 | |

| 21/12/2012 | Spot FX AUD/USD | 10501 | 0.5 | 10451 | -25 | -50 | |

| 18/12/2012 | Spot FX GBP/JPY | 13258 | 0.5 | 13658 | 200 | 400 | |

| 24/12/2012 | Spot FX USD/JPY | 8262 | 0.5 | 8462 | 100 | 200 | |

| 16/12/2012 | Spot FX GBP/JPY | 13214 | 0.5 | 13629 | 207.5 | 415 | limit higher gap |

| 16/12/2012 | Spot FX USD/JPY | 8136.5 | 0.5 | 8336.5 | 100 | 200 | |

| 12/12/2012 | Spot FX GBP/JPY | 12966 | 0.5 | 13366 | 200 | 400 | |

| 10/12/2012 | Spot FX EUR/JPY | 10700 | 0.5 | 10600 | -50 | -100 | |

| 09/12/2012 | Spot FX EUR/GBP | 8091.6 | 0.5 | 8035.3 | -28.15 | -56.3 | gapped down |

| 07/12/2012 | Spot FX EUR/JPY | 10744 | 0.5 | 10644 | -50 | -100 | |

| 06/12/2012 | Spot FX EUR/JPY | 10764 | 0.5 | 10664 | -50 | -100 | |

| 06/12/2012 | Spot FX EUR/GBP | 8136 | 0.5 | 8086 | -25 | -50 | |

| 30/11/2012 | Spot FX EUR/JPY | 10376.7 | 0.5 | 10736.7 | 180 | 360 | |

| 28/11/2012 | Spot FX AUD/USD | 10478.6 | 0.5 | 10428.6 | -25 | -50 | |

| 28/11/2012 | Spot FX GBP/USD | 16043 | 0.5 | 15983 | -30 | -60 | |

| 27/11/2012 | Spot FX EUR/USD | 12992.9 | 0.5 | 12943 | -24.95 | -49.9 | |

| 23/11/2012 | Spot FX USD/CAD | 9982 | 0.5 | 9932 | -25 | -50 | |

| 23/11/2012 | Spot FX USD/CAD | 10010 | 0.5 | 9960 | -25 | -50 | |

| 22/11/2012 | Spot FX USD/JPY | 8071 | 0.5 | 8271 | 100 | 200 | |

| 22/11/2012 | Spot FX EUR/GBP | 8019 | -0.5 | 8069 | -25 | 50 | |

| 20/11/2012 | Spot FX USD/JPY | 7961 | 0.5 | 8175 | 107 | 214 | |

| 14/11/2012 | Spot FX EUR/USD | 12697.6 | -0.5 | 12747.6 | -25 | 50 | |

| 14/11/2012 | Spot FX EUR/JPY | 10079 | -0.5 | 10179 | -50 | 100 | |

| 14/11/2012 | Spot FX GBP/JPY | 12588 | -0.5 | 12688 | -50 | 100 |

|

Total Points Made: 1644.8

As you can see from my trades the system has been very successful and overall I would say I am around 65.79% up after making 1644.8 points, which is pretty good. Obviously, I’ve only been doing this system for 2 months where really you would need to test out a system for at least over a year to tell how well it’s actually doing. Also this is only from my experience and is for educational purposes only and does not constitute as advice. If you want to try any trading system make sure you do your own research and keep in mind that with any type of trading there is always a high risk.

I hope you found my blog useful and I will keep you updated about this system in the coming months. I will also be testing out a few other trading systems including RMO and Turtle trader, which are two systems that come free with MetaStock. I will be writing blogs on these systems as well so please checkout our blog section for updates.

Happy Trading!

Trackback URL for this blog entry.

Comments

-

Saturday, 12 January 2013

Saturday, 12 January 2013Its a good system but people should realise that most of the profit was from JPY. So dont presume that it will get great returns all the time as you also need the other pairs to pull there weight . This system should be tested for at least 6 months to a year. That way you should be able to get a better idea . Also this system is very effective when the trend is strong like the jpy

Hi Ronnie, thanks again for sharing this with us. I notice for GBP/JPY pair you closed for 400 points rather than 200. Was this due to other signals?