- Font size: Larger Smaller

- Hits: 52013

- 0 Comments

- Subscribe to this entry

- Bookmark

Trading Systems

Trading systems have been used all over the world for centuries, why are they so popular you may ask? Well it's because of the many benefits the trading systems provide such as providing entry and exit points, taking the emotion out of your trading, providing a plan and consistency and hopefully making you some profit.

This blog will be looking at a few of these trading systems and looking at how they work and how they perform. There are so many trading systems to choose from that it can be hard to decide which one to use but it does depend on what type of trader you are and the level of risk and complexity you would like to take.

Whatever trading system you decide to use you should try to have a few rules in place things like:

• Try to stick to one trading system at a time, you don't want to overtrade and confuse yourself!

• Test out the system fully before you actually place a real trade with real money! This is where you will be able to tell if the trading system works for you or not.

• Stick to your money management rules.

• Try to stick to the rules of the trading system, of course you can adapt it but don't change it completely as the rules are usually there for a reason.

• Remember any type of trading carries risk.

These are just some of the rules, I'm sure you will have many more.

1-Hour Trading System

In this first blog I will be looking at the 1-hour trading system, I have chosen this particular trading system because it is very simple and I like simple :)

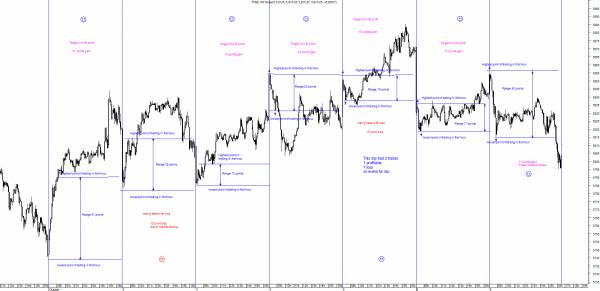

So what is the trading system? Well it works on the basis that the first hour of trading sets the tone for the rest of the trading day, this is based on a 5-minute chart.

So you take the first hours high and the first hours low and find the different in points range, you would then use this as your trading range. You would do a buy bet at the first hour high price and set the stop loss at the trading range, you do the same thing for the sell bet, you do a short on the first hour low price and set the stop loss at the trading range. The prices should move in the direction of the breakout an amount equal to the range of the first hours trading.

Whatever happens, you should exit at the end of the day if neither your stops or limits gets hit as you should not keep any over night positions. Also another rule is that if the trading range on the first hour is very large say more than 40 points then it's best to not to open a trade for that day and come back the following day. The reason for this is that the higher the trading range the more risk involved in the trade, the ideal range is from 10-30 points in the first hour. As you can see this 1 hour trading system is quite an easy system to follow.

So what was the system for Day 1 Monday 17th August?

The first hour has 60 point range.

The First hour high : 6585.80

The first Hour Low : 6526.65

Long entry is 6586...Target 6646

Short Entry is 6526...Target 6466

Stops are 60 points and Targets are 60 points for Today.

(Charts created using MetaStock Pro 14, Try it now for free for 2 months - MetaStock Free)

As there is such a high points range this trade would be too risky and therefore no trade would be done.

We have to wait for the next day to see if a trade is possible.