Chartsview blog

General trading and all to do with financial markets

First Touch Rule Trading System

in ChartsView Blog:This is something that I have created for my style of trading.

The idea being that if you know of a strong Resistance area or Support Then I would place my shorts or Longs at that exact level. This method can be going against the trend some times.

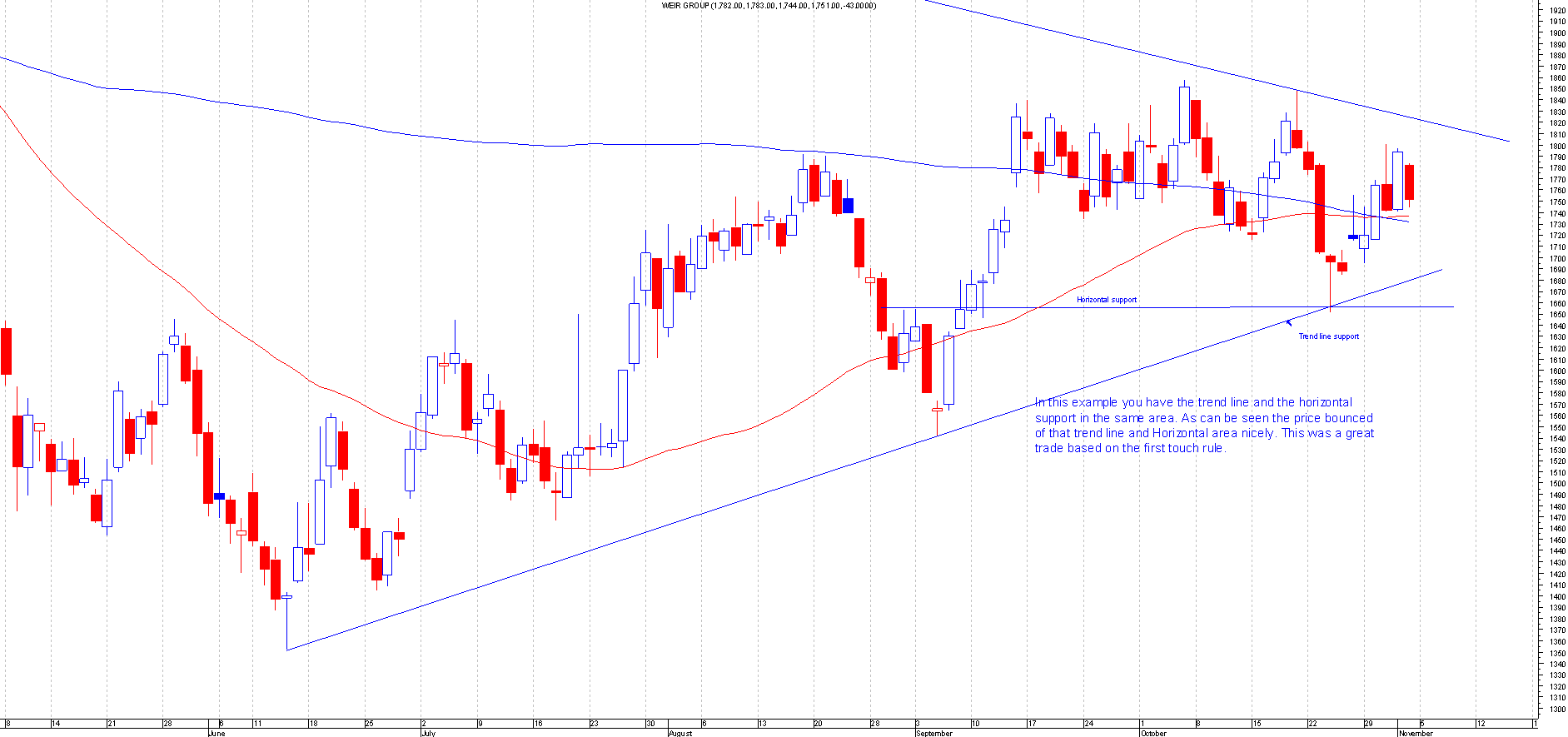

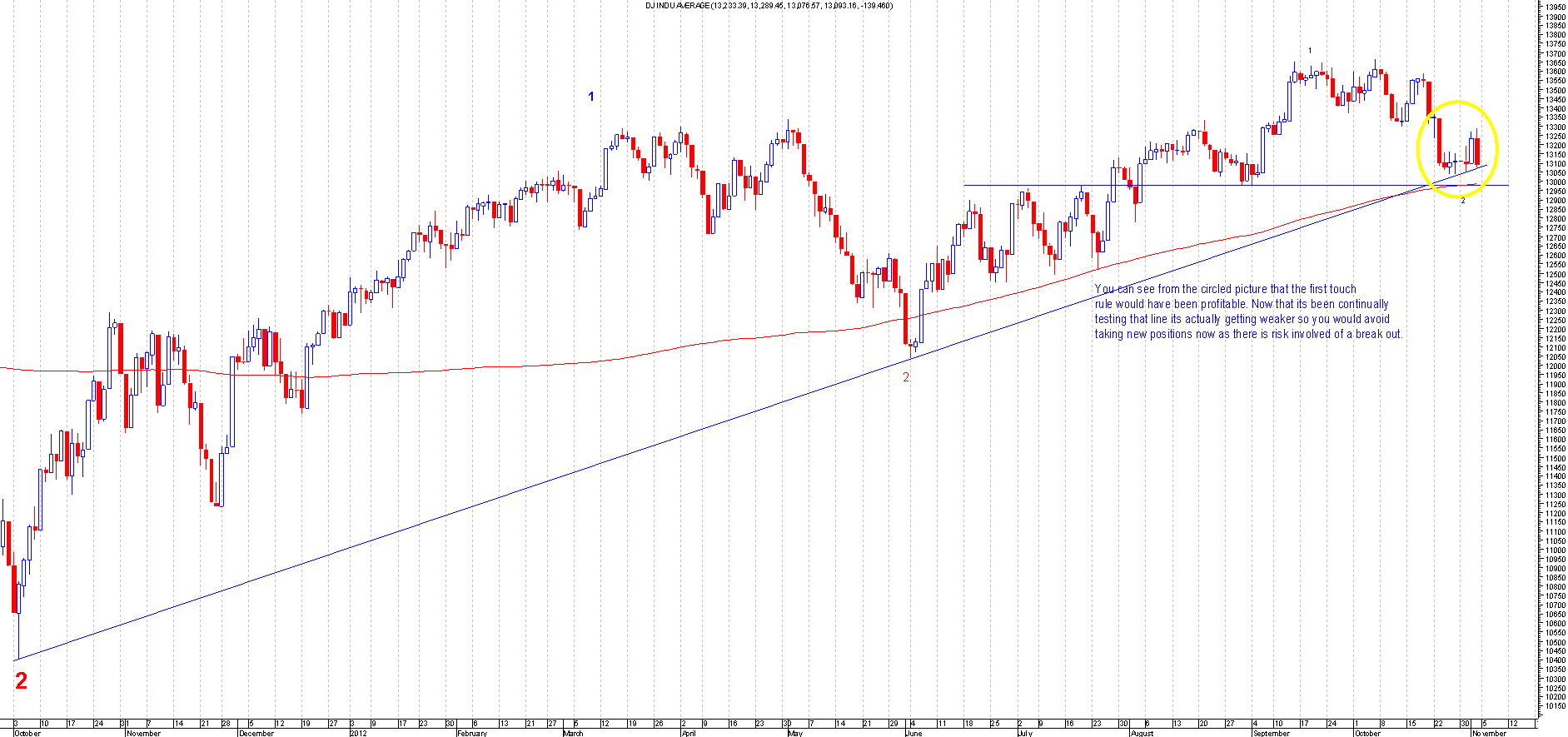

For shorting (betting down), I would take out shorts at known resistance levels. Not just any resistance level. The level should be an important level and not just a conventional resistance. It should be a trend line or gaps or the level should have 2 or more resistance levels converging. The more the better

See example below:

The idea being that you're respecting the resistance or support level. You're basically placing your trade where all the smart money is lined up. At a good resistance level there will be a lot of people closing or taking profits at that area. It's using technicals to determine the best level to short in the case of the resistance level.

This method has been very profitable to my style of trading. I always use a tight stop when trading of key levels due to the breakout factor. Once a key level gets breached it's normally violent, hence the breakouts. I'll say 90% of the time trying to catch a breakout will be costly so that's why I have created this method to help me as its betting on the breakout to fail.

If you read a lot of technical books it talks about trying to catch the breakouts. Well I have found that it's a risky game trying to catch the breakout it's probably the worst thing someone can do, this is another subject all together.

The first attempt basically is as the name suggest only on the first attempt of that area. The more times that area is tested on the same day or the day after the more likely it's going to breakout. If you have found a perfect level to place a first attempt trade then you will find that the price will usually bounce fast and head in your direction fairly quickly giving you ample time to take profits yourself and giving yourself a free trade based on the 3 contract rule (See 3 contract rule).

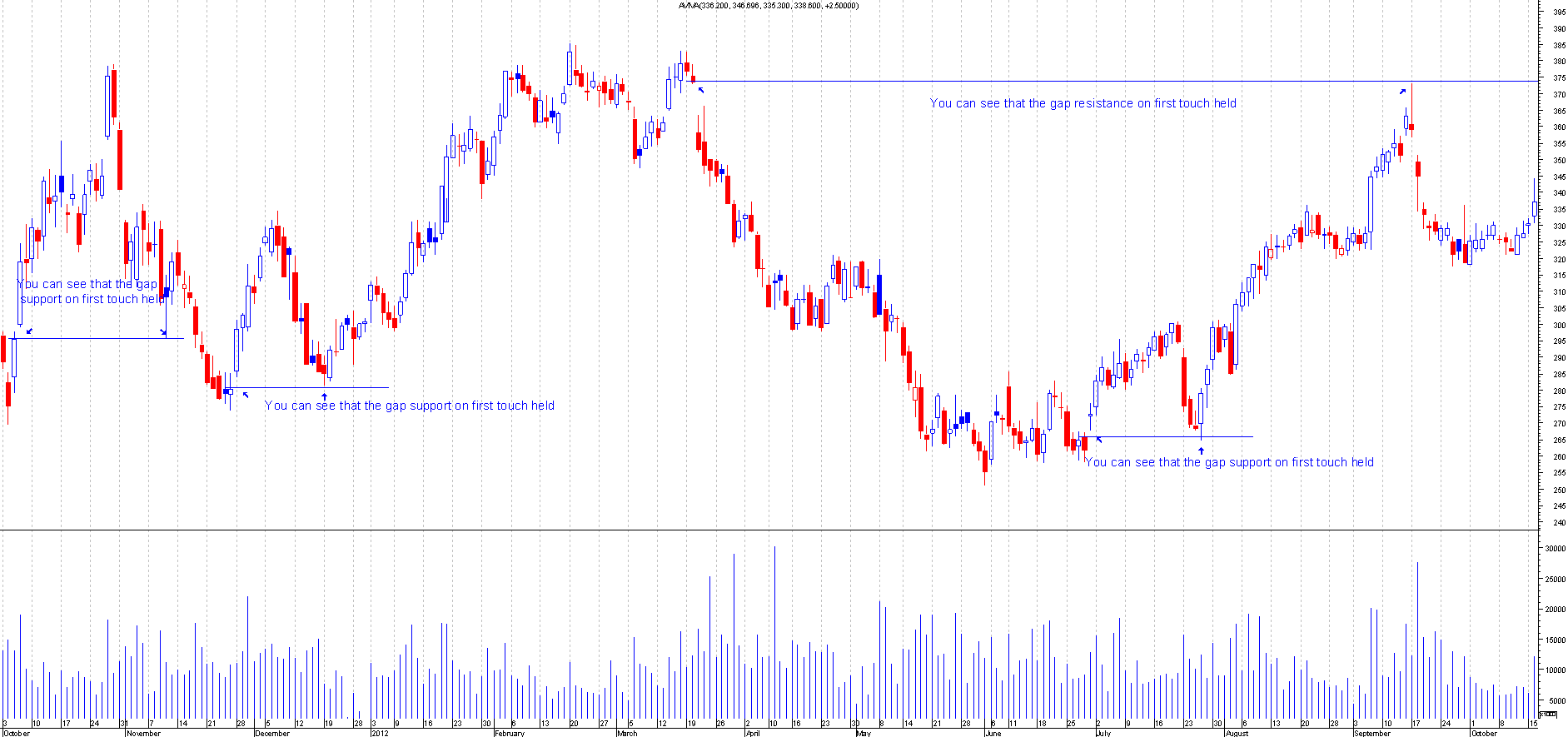

I use this system a lot on test of gap resistance or supports whenever it fills it I will short or go long. This could be done with the trend.

See example below:

The power of the "U" for those who know?