Chartsview blog

General trading and all to do with financial markets

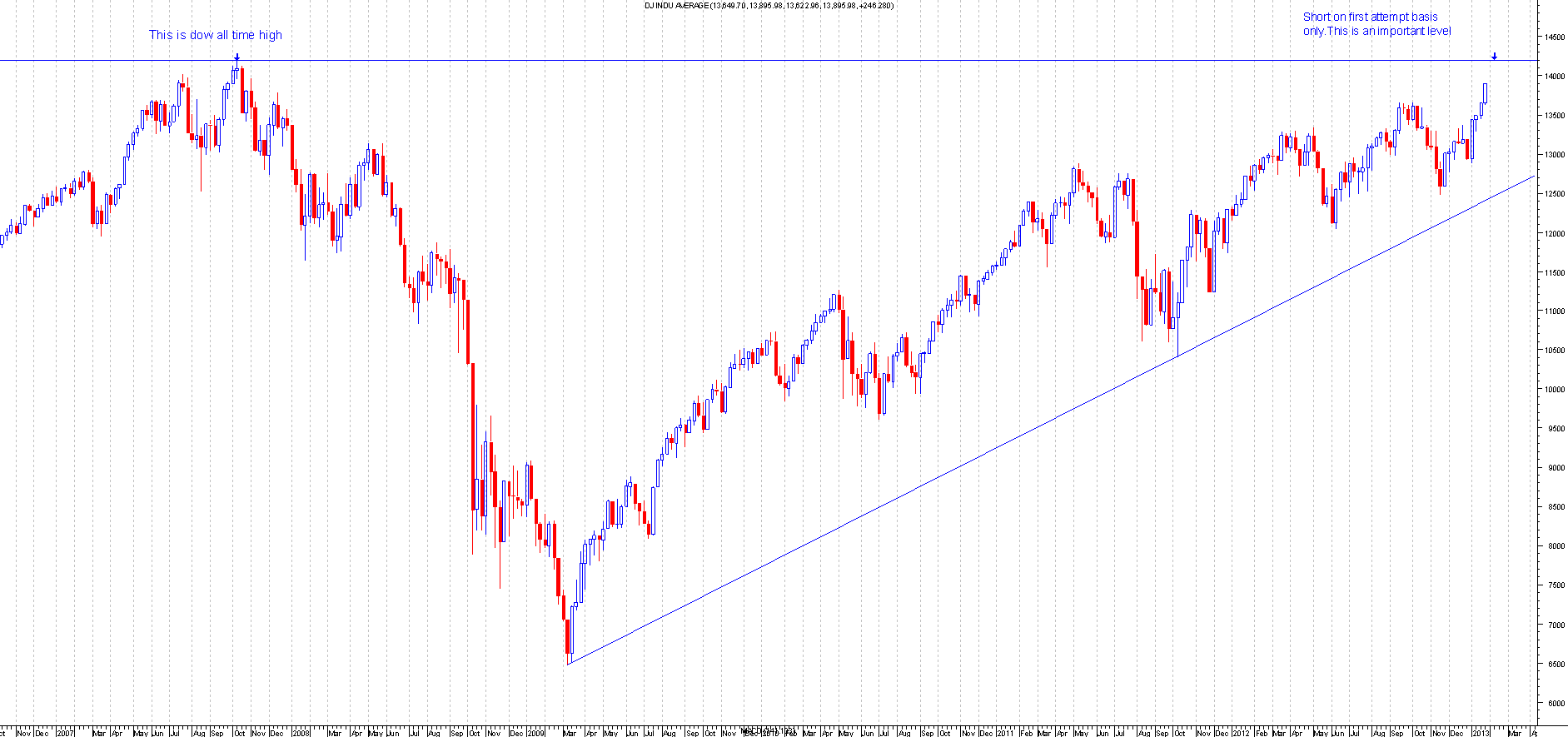

Dows - All Time High Approaching

in ChartsView Blog:- Font size: Larger Smaller

- Hits: 9356

- 0 Comments

- Subscribe to this entry

- Bookmark

The Dow Jones Index is approaching a very important level

The Dow Jones (Dow) is approaching its all time high and this level is an important level as everyone knows that this is the highest the Dow has ever reached. I would be very surprised if the high got taken out on the first attempt, so for this reason I would short the Dow at 14198 with a 40 point stop during market hours only.

I won't short this level if the Dow closes very near to this level from the previous day, the attempt should be from a far away distance like 100 points away. Whenever it closes near a major resistance then the chances of a breakout are higher so hence why this trade should be done from a far away basis only.

Another reason for the short is due to the double top possibility whenever I see a share or index approach a double top scenario I always short on first attempt. I always prefer a double top short if the time since the last high is over a year ago or more. This way the high means more and this is just my personal feeling on the subject.

The reason it should be from first attempt only is due to all the shorts lined up at or near that level, it's a well known level so it's gonna put up a fight. If it pushes back on the first attempt then it re-tries again on a second attempt fairly soon after then chances are there won't be as many shorts there as the last time so higher chance of it breaking through.

A good resistance level should not breach on first attempt otherwise it's not resistance. It will need some thing special to break through this level on first attempt basis like a market moving news and that's why it's wise to have a stop in play and trade this during market hours only, as then the chances of the news causing whip saws are smaller.

This is due to all the main news being released before the market is open (13.30pm UK time). If you placed a trade before the market is open then you may get caught up in the crazy market moving hour before the market is open as the swings can really be wild so a lot of stops will be taken out.

The above is just my feelings on the Dow and people should only trade the Dow if your experienced, it's not a forgiving index so only trade what you can afford to lose.

Always use stops and never trade more than 2% of your trading capital on one trade.

Most important is

DYOR(Do Your Own Research)

Trackback URL for this blog entry.