Articles

Bearish Engulfing Pattern

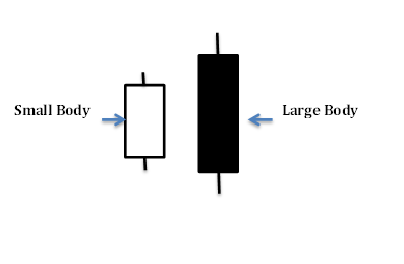

This pattern consists of a small white candle followed by a large black candle; the large black candle has opened higher but has closed lower than the previous day thus is engulfing the small white candle.

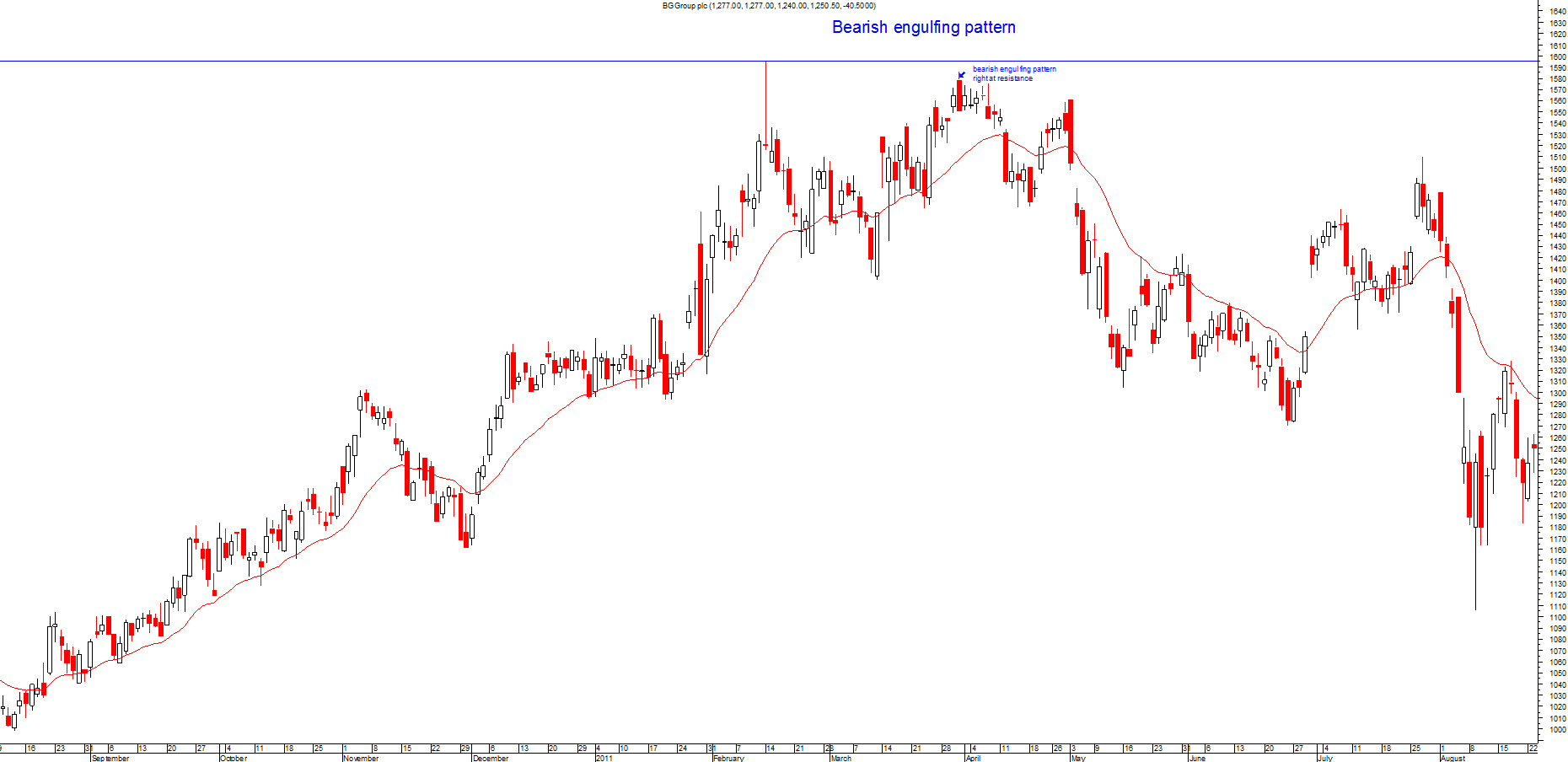

The significance of this pattern is that it usually comes after an up trend and therefore indicates a major reversal in the markets.

It signifies a bearish market where bears have won out and that the buying has stopped therefore this pattern could be used as a signal to short trades.

Please click on picture above to get a larger picture

Most candlestick patterns should appear close to previous resistance or support levels depending on what type it is. You should only trade a candlestick pattern if it's near these levels.

Don't trade using these patterns if it's not at the top or bottom of a trend. These patterns appear a great deal so you have to make certain you only trade at the right level.

This is very important as you will end up over trading them and you will end up losing more money than you imagined.