Just a quick heads up but from Tuesday I will start my "charts chool"...it will start with the very basics of charting and offer a full support service via my own email account where I will be able to "tutor" a few individuals who have the commitment, time, dedication and passion for charting. I've neglected the blog for several weeks and I've always got my enjoyment from learning and teaching the art of charting. It will comprise of links, charts, but the most important aspect will be the vidoe charts so you can see how it is done "live" ......look forward to my first blog update on Tuesday....I always like people to teach me as though I am a "numpty" or a "dunce"...it's better that way as you learn and then have a reference point to revisit.

Ok here's the first few vids covering:-

1) Advfn charting..how to register and access charts

http://screencast.com/t/xti83UaF

2) Timeframes...

Continue reading

Tradesmarter

Tradesmarter has not set their biography yet

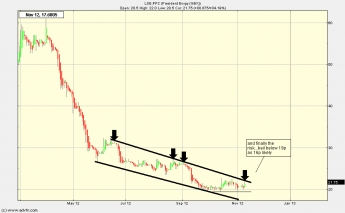

well borrowed this idea from another chartist on advfn...I just happen to agree with the risk/reward so have done "my take" on it....but credit to Fingers thread to this idea and to the poster Jamesiebabie....For me, well I see many shares bouncing at 20p to 26p and a close below 1p should be used to admit defeat...so a decent risk/reward and always the possibility of a supa spike!....but as this is aim don't play unless you can handle an immediate 30% loss for the change of a sustained rise on good news...for now I'm just calling for a quick technical bounce at the key 20p area...rest is down to you ...

Continue reading

So will the President do a "U" turn over the next 6 months and will previous long term supporters, turn resistance?...

Continue reading

still in downtrend and scalpers should target 20-22p, whilst others may want to wait till 22p resistance taken out (also be aware of the gap circa 23p)....In earnest a break above 23p is what will set the bull flag alert....

Continue reading

Well 4 charts to show the risk and the reward, remember good traders (even speculative risk/reward junkies like myself) focus on what they could lose before the lok at what they could gain.....with a punt with a small investment or lose change this could just deliver.....either way is shows that that a chartist (or chancer) really can show people how a stock can be bullish or bearish or both on different timeframes.....for me this is worth the "gamble" but that doesn't mean it is free from risk....remember when support goes it's usually 20% lower...but many small oil plays have re-rated recently and some have doubled and trebled....so from that perspective I think the 20-30 risk is acceptable if it does gap below 19p etc....you guys n gals press the button!

...

Continue reading