Trading Systems Day 3

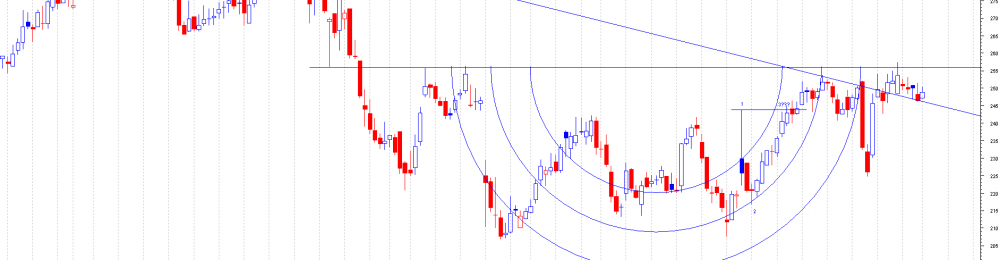

This blog is a continuation looking at trading systems, in particular the 1 - hour trading system.

Today is Day 3 of trading systems, so what did the markets do today?

1 Hour Trading System

Day 3 - 19th August 2015

Today's first hour has 47 point range.

The First hour high : 6509.06

The first Hour Low : 6463.39

Long entry is 6510...Target 6557

Short Entry is 6463...Target 6416

Stops are 47 points and Targets are 47 points for Today.

This falls a little bit outside the acceptable points range but I would still place a trade.

(Charts created using MetaStock Pro 14, Try it now for free for 2 months - MetaStock Free)

...

Continue reading

Trading Systems Day 2

This blog is a continuation looking at trading systems, in particular the 1 - hour trading system.

Today is Day 2 of trading systems, so what did the markets do today?

1 Hour Trading System

Day 2 - 18th August 2015

Today's first hour has 38 point range.The First hour high : 6564.55The first Hour Low : 6527.79

Long entry is 6565...Target 6603Short Entry is 6527...Target 6489Stops are 38 points and Targets are 38 points for Today.

This falls into the acceptable points range so a trade would have been placed today.

(Charts created using MetaStock Pro 14, Try it now for free for 2 months - MetaStock Free)

...

Continue reading

This blog is an update from the share tips from 21st October to 3rd November 2013 from the Premium Section called Share Tips.There was a possible 390+ points profit to have been made.This obviously assumes the max possible and some of these shares have since closed out and some are still active.

This blog is going to be done like the previous blogs where it will show you the before picture and after pictures of the shares. This is the best way to show this, as its easy to follow and as many know I don't do hindsight trading like many so called pros out there. This blog will show this. I will put the dates on the companies tipped so that members can check when the tips were done so that you know it's the real deal. Like I have said there is no hindsight trading. It's all done by...

Continue reading

Despite the markets' current bearishness and the concern over the US budget and debt ceiling, I think the S&P is worth a long at this uptrend support with stops below it.This support comes from the Nov 2012 low and has played an important role since then, coming into play on at least 4 previous occasions. IMHO this is the support for Primary wave 3 so if this wave is to continue it will need to hold; if it fails then it will likely mean that Primary 3 is over and we're into Primary 4 which should be a long, volatile and unpredictable sideways drop.The level in play here is 1664 so that's where I'll have an order with stops below 1660 Original link...

Continue reading

This is an update of the shares that that have been tipped since 2nd september to 20th October in the Premium section called "Share Tips". It's been very profitable netting in excess of 1500 points from the combined shares tipped.

This blog is going to be done like the previous blogs where it will show you the before picture and after pictures of the shares. This is the best way to show this, as its easy to follow and as many know I don't do hindsight trading like many so called pros out there. This blog will show this. I will put the dates on the companies tipped so that members can check when the tips were done so that you know it's the real deal. Like I have said there is no hindsight trading. It's all done by pure charting, here goes.

2nd September 2013

BALF.L

Before: This is the Chart...

Continue reading