Articles

Point and figure charts are distinctive in terms of their analysis and construction. Unlike other charts, time does not play a big factor.

They are plotted on a grid and are made up of 0's and X's. O's are used when the price moves down and X's are used when they go up. Each box on the grid will be used for 0's or X's.

Prices movements are plotted on the vertical axis(y axis) and direction changes are plotted on the horizontal axis(x-axis), prices are scaled on the vertical axis. A box represents the number of points that you have selected.

When the price goes up then you would mark it with an X but only when the market price rises completely through the box then you would place an X in the box.

So every full box size will generate an X. For 0's to be generated the price must reverse a minimum of 1 box (1 box reversal) but most commonly used is a 3 box reversal, which requires the correction of 3 boxes before the 0's can be plotted. This will help filter out most of the noise so time is not really a factor.

So once in the trend the next X or 0 will only need 1 box move to register on the chart where as a reversal will require 3 box move in the opposite direction to register. That's why its called a 3 box reversal.

You can change the setting to what you want. You can use a 5 box reversal but remember this will take a lot longer to see the movements on the chart. So the usual preference is the 3 box reversal and this is the most common one.

Another way to change the setting will be the price move itself e.g.

• 1 * 3 box reversal. for every point move. Reversal require 3 points

• 2 * 3 box reversal. For every 2 points move. Reversal require 6 points

• 3 * 3 box reversal. For every 3 point move. Reversal require 9 points

• 5 * 3 box reversal. For every 5 points move. Reversal require 15 points

• 10 * 3 box reversal. For every 10 points move. Reversal require 30 points

• 50 * 3 box reversal. For every 50 points move. Reversal require 150 points

• 100 * 3 box reversal. For every 100 points move. Reversal require 300 points

The following table will help you to decide what box sizes to use, you should really try and experiment with different box sizes to suit your share.

price | Suggested Box size |

10 -50 | 1 |

50 -250 | 3 |

250-500 | 5 |

500-1500 | 10 |

1500-5000 | 50 |

5000+ | 100 and above |

As can be seen from the chart below. When prices reverse, the X or the 0 is not in the same column.

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

|

|

|

|

| x |

| x |

16 |

|

|

|

|

|

|

|

|

|

|

| x |

| x | o | x |

15 |

|

|

|

|

|

|

|

|

|

|

| x | o | x | o | x |

14 |

|

|

|

|

|

|

|

|

|

|

| x | o | x | o | x |

13 |

|

|

|

|

|

|

|

|

|

|

| x | o | x | o | x |

12 |

|

|

|

|

|

|

|

|

|

|

| x | o | x | o | x |

11 |

|

|

|

|

|

|

|

|

|

|

| x | o |

| o |

|

10 |

|

|

|

|

| x |

| x |

| x |

| x |

|

|

|

|

9 |

|

|

|

|

| x | o | x | o | x | o | x |

|

|

|

|

8 |

|

|

|

|

| x | o | x | o | x | o | x |

|

|

|

|

7 |

|

|

|

|

| x | o | x | o | x | o | x |

|

|

|

|

6 |

| X |

| x |

| x | o |

| o |

| o |

|

|

|

|

|

5 |

| X | o | x | o | x |

|

|

|

|

|

|

|

|

|

|

4 |

| X | o | x | o | x |

|

|

|

|

|

|

|

|

|

|

3 |

| X | o |

| o |

|

|

|

|

|

|

|

|

|

|

|

2 |

| X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

| X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Every reversal will start in a new column and it must reverse by 3 to generate a reversal. For example:

If you are plotting a 5 by 3 (5*3) 5=box size and the 3=reversal.

If the latest box to be filled is 300 and the price rises to 305 then you would place another x in the 305 box. If then the price rises to 309 then you would ignore this as it has not moved by 5 points.

If the price suddenly moves to 323 then you would place an x up to the 320 mark(310,315,320). You would discard the 323 price as it has not moved by 5 clear points.

If the price then turns down and moves to 313 you would still not plot any 0 as it has not corrected by 3 box sizes.

For a new set of 0's to be plotted the price must move 5*3=15 points. So the current high is 320 – 15 points so 305 will be the level before a new set of 0's can be plotted. Every box is equal to 5 points.

So once 305 is hit then you would plot an 0 in 315, 310 and 305. So hence a new column of 0's.

All the above is based on intraday moves. Most point and figure charts are done on intraday.

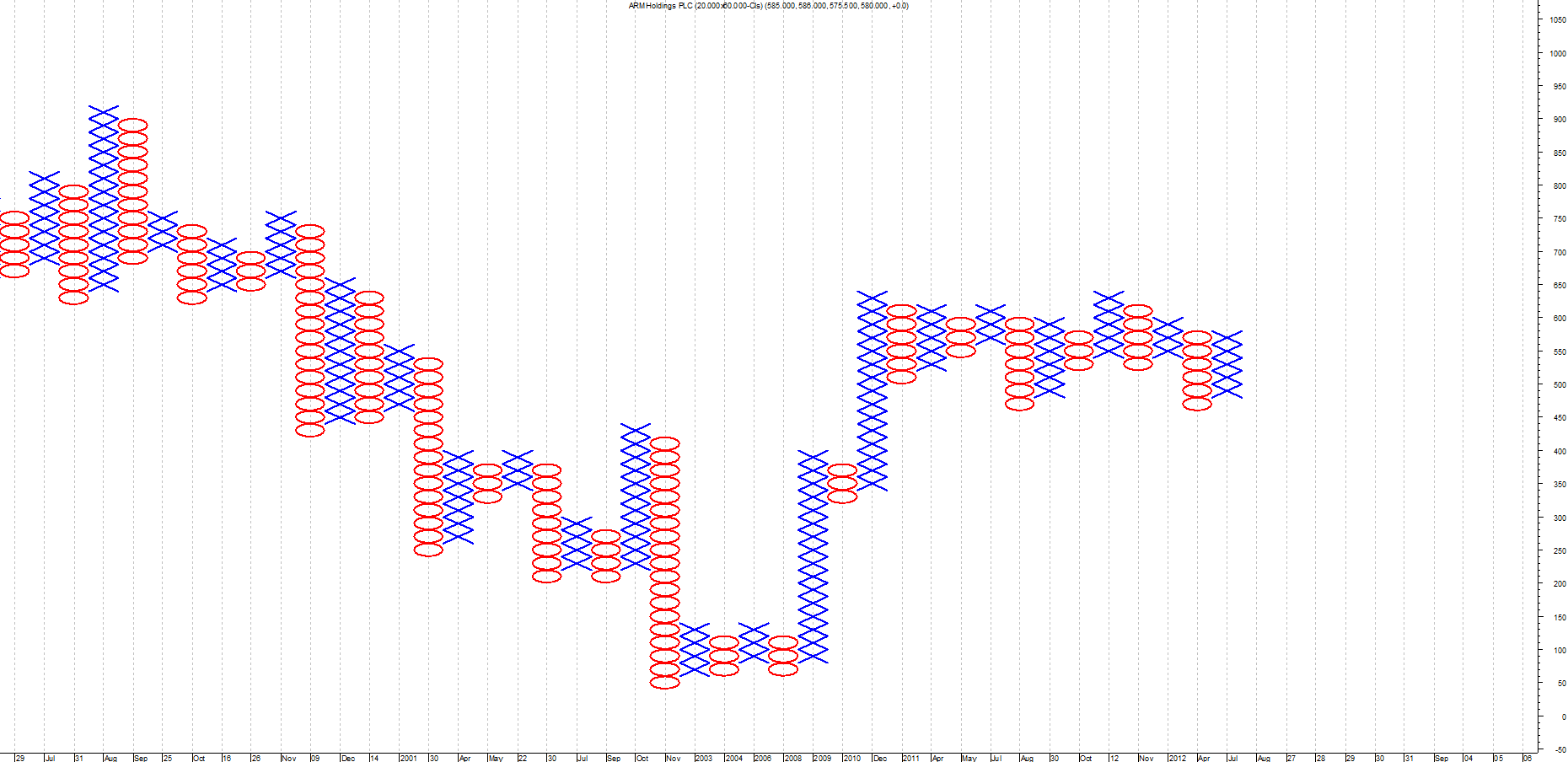

End of day

There are different time frames you can use with point and figure. End of day point and figure is plotted exactly like the intraday point and figure but only the closing price is used. So it misses a lot of the intraday moves, a bit like the line charts where all the important levels will be missed.

See chart below

Please click on picture below to get a larger image

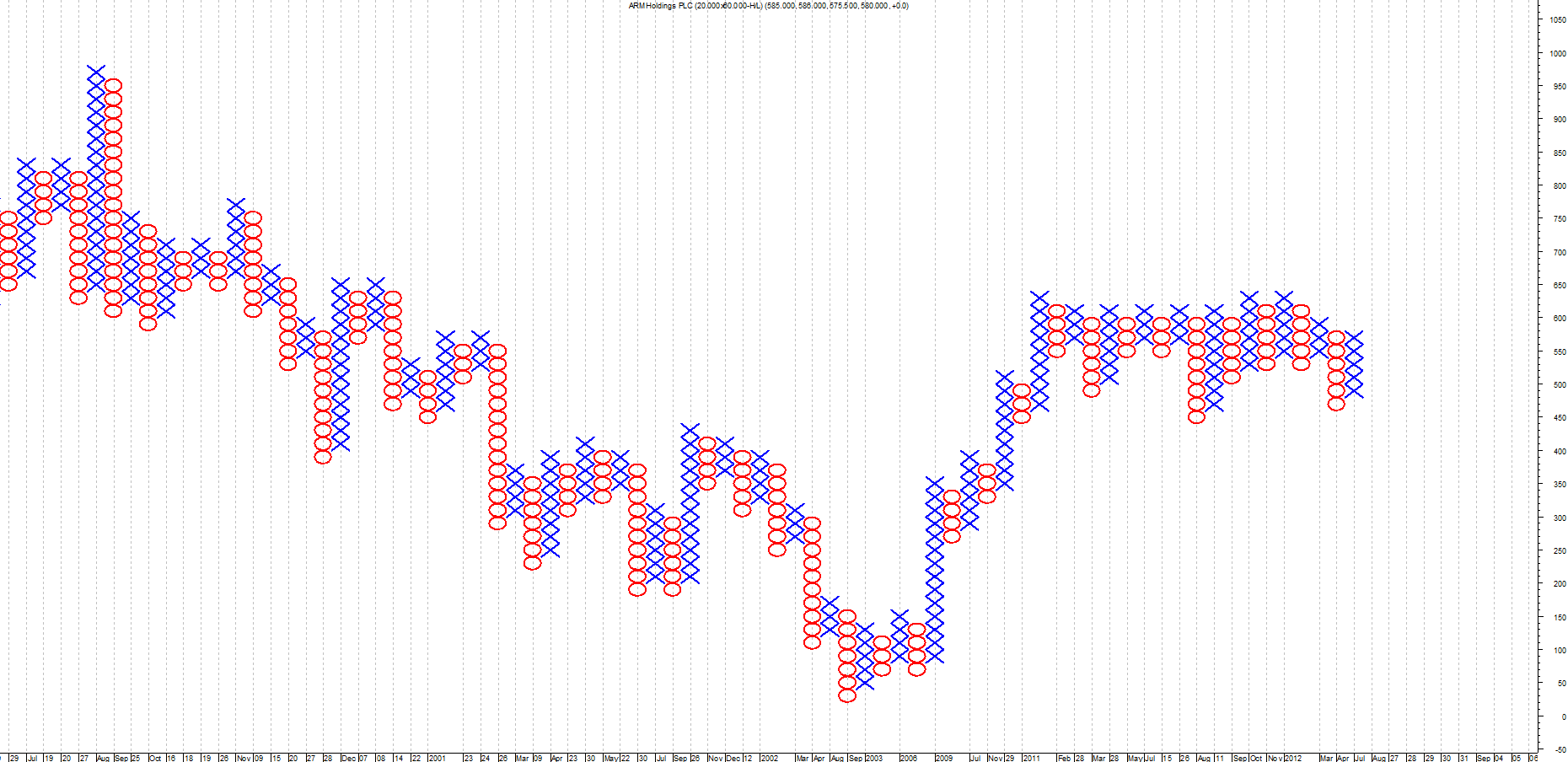

High/low

This method uses the whole days moves so you use a lot more data. It totally ignores the closing prices. This method has the advantage that you can read the supports and resistances levels much better and clearer.

See chart below

Please click on picture below to get a larger image

Trend lines

• Trend lines are drawn from an extreme bottom or top with a 45-degree angle attached to it.

• Bullish trend lines are drawn from a known low at 45-degrees pointing upwards.

• Bearish trend lines are drawn from a known high at 45-degrees pointing downwards.

Common Buy and Sell Indicator

| Double Top Breakout | ||

|---|---|---|

| X | ||

| X | X | |

| X | O | X |

| X | O | X |

| X | O | |

| X | ||

←Buy

| Double Bottom Breakout | ||

|---|---|---|

| O | X | O |

| O | X | O |

| O | X | O |

| O | O | |

| O | ||

← Sell

| Triple Bottom Breakout | ||||

|---|---|---|---|---|

| O | X | X | ||

| O | X | O | X | O |

| O | X | O | X | O |

| O | X | O | X | O |

| O | O | O | ||

| O | ||||

← Sell

| Triple Top Breakout | ||||

|---|---|---|---|---|

| X | ||||

| X | X | X | ||

| X | O | X | O | X |

| X | O | X | O | X |

| X | O | X | O | |

| X | O | |||

← Buy

| Upside Triangle | ||||

|---|---|---|---|---|

| X | ||||

| X | X | X | ||

| X | O | X | O | X |

| X | O | X | O | X |

| X | O | X | O | |

| X | O | X | ||

| X | O | |||

| X | ||||

← Buy

| Downside Triangle | ||||

|---|---|---|---|---|

| O | ||||

| O | X | |||

| O | X | O | ||

| O | X | O | X | |

| O | X | O | X | O |

| O | X | O | X | O |

| O | O | O | ||

O | ||||

← Sell

| Symmetrical Triangle | |||||

|---|---|---|---|---|---|

| O | |||||

| O | X | ||||

| O | X | O | X | ||

| O | X | O | X | X | |

| O | X | O | X | O | X |

| O | X | O | X | O | X |

| O | X | O | X | O | |

| O | X | O | X | ||

| O | X | O | |||

| O | X | ||||

| O | |||||

← Buy

| Symmetrical Triangle | |||||

|---|---|---|---|---|---|

| O | |||||

| O | X | ||||

| O | X | O | |||

| O | X | O | X | ||

| O | X | O | X | O | |

| O | X | O | X | O | |

| O | X | O | X | O | |

| O | X | O | X | O | |

| O | X | O | O | ||

| O | X | O | |||

| O | |||||

← Sell

Price Targets

Point and figure charts have the ability to project targets, there are 2 ways to count these either using the horizontal or the vertical count.

- Vertical count. Upwards Target - This is done by counting the number of X's in the move up then multiply by the box size and then multiply by the reversal box, i.e. number of X's 6, Box size 1, reversal box size 3 and Target = 18. Once you have your target you use the previous low of O's as the bottom and then you project it from there, you have your target. This is best used from a low point and the reverse is true for downside targets.

| 8 | X | ||||

| 7 | X | X | |||

| 6 | X | O | X | ||

| 5 | X | X | O | X | |

| 4 | X | O | X | O | |

| 3 | X | O | X | ||

| 2 | X | O | X | ||

| 1 | X | O |

← Target 18

- Horizontal Target -This is done using congestion area (sideways moves). The way to do the count is for an upside Target Columns x Box size x Reversal. You need to use the move that started the congestion and count from there to the move out of the congestion. So if there are 10 columns( including the start and finish columns) you would multiply that by the box size and then multiply that by the reversal so if box size is 5 and reversal is 3 then you would have 10x5x3 = 150 points target. This then is added to the lowest point of the congestion and projected up from there. The reverse is true for a downside target.

| X | ||||||||

| X | ||||||||

| X | X | X | X | |||||

| X | O | X | O | X | O | X | ||

| X | O | X | O | X | O | X | X | |

| X | O | X | O | O | X | O | X | |

| X | O | X | O | X | O | X | ||

| X | O | O | O | |||||

| X |

There are many different signals on the point and figure charts and so you do really need to read about them first. The above is just an introduction to point and figure charting.

Advantages

• From the charts you can see almost the entire trading history on one page.

• Easy to see buy and sell signals.

• Trend is clear to see.

• Point and figure charts have targets.